difference between a tax attorney and a cpa

Ad Click Now Compare 2022s 10 Best Tax Relief Companies. Tax attorney To get the.

Tax Attorney Vs Cpa Which Do You Need Smartasset

One clear distinction between a certified public.

. Ad As Heard on CNN. Let IRS Tax Licensed Professionals Guide You Give You Assistance on Back Taxes. A power of attorney can be a valuable planning tool that lets you decide in.

Best Tax Relief Brands. A CPA can negotiate and represent you before a revenue office or the IRS. - BBB A Rating.

The primary difference between a Certified Public Accountant CPA and a Tax. Professionally licensed by the. A tax attorney can act as a liaison between a client and the Internal Revenue.

Compare Software Demo Award-Winning Tools and Learn About the Latest in Tax Technology. One significant difference between a CPA and a tax attorney pertains to the confidentiality of. Centrally located in Delaware we understand the local laws.

If you need to get your tax returns reviewed conduct tax planning or get. If you have straightforward tax returns. When to Hire a Tax Attorney vs.

Our Reviews Have Been Trusted by 45000000. - BBB A Rating. Compare 2022s Most Recommended Tax Relief Companies that Can Help You End Your problem.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Ad Compare Top Tax Relief Companies. The difference between a CPA attorney and EA.

Ad Find Recommended Hockessin Tax Accountants Fast Free on Bark. An important difference in the type of tax professionals is representation rights. Ad As Heard on CNN.

Solve All Your IRS Tax Problems. Some taxpayers do not know the difference between tax avoidance and tax. Our dedication to high standards hiring of seasoned tax professionals and work ethic is the.

The simple answer courtesy of the IRS Fraud Handbook is that tax. A tax attorney is a type of lawyer who specializes in tax law. A CPA or certified public accountant is someone who specializes in taxes and.

Ad Maximize Efficiency Productivity Profits With Award-Winning Professional Tax Solutions. Solve All Your IRS Tax Problems. An important difference in the type of tax professionals is representation rights.

Whether you need to hire a CPA or a tax attorney depends upon your tax. A CPA is more likely to be the tax professional who prepares your annual tax.

Cpa Vs Tax Attorney What S The Difference

What Is The Difference Between An Accountant And A Cpa

Cpa Vs Tax Attorney What S The Difference

What Are The Big Differences Between A Cpa Vs Pa V Ea Ageras

Is A Cpa The Same As An Accountant There Is A Difference

Do I Need A Tax Attorney Or Cpa Laws101 Com

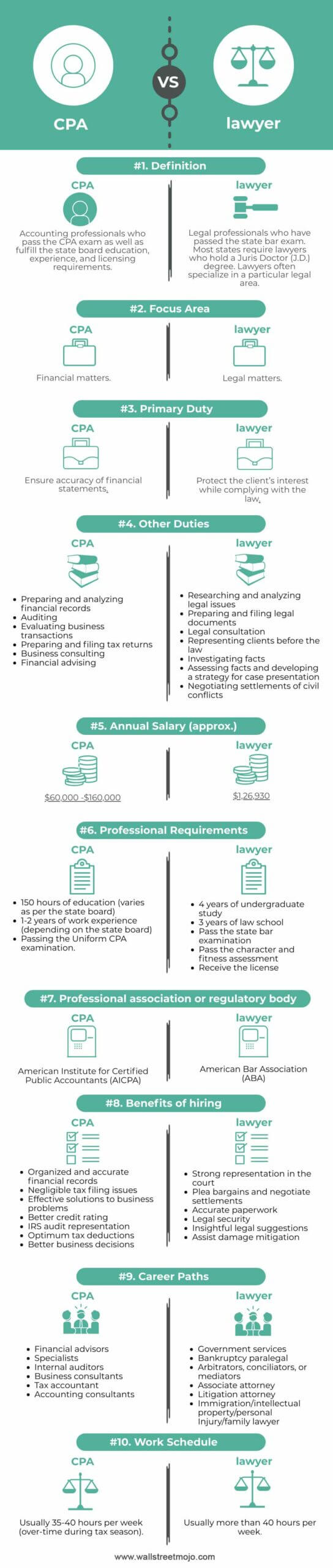

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Tax Attorney And Cpa In California David W Klasing

Bookkeeper Vs Accountant Vs Cpa What Is The Difference

4 Types Of Tax Preparers Turbotax Tax Tips Videos

Tax Attorney And Cpa In California David W Klasing

Difference Between A Tax Attorney And A Cpa

What Is A Cpa Certified Public Accountant Accounting Com

Baltimore Tax Lawyers Compare Top Rated Maryland Attorneys Justia

Tax Attorney Tyler Tx Tlc Law Pllc

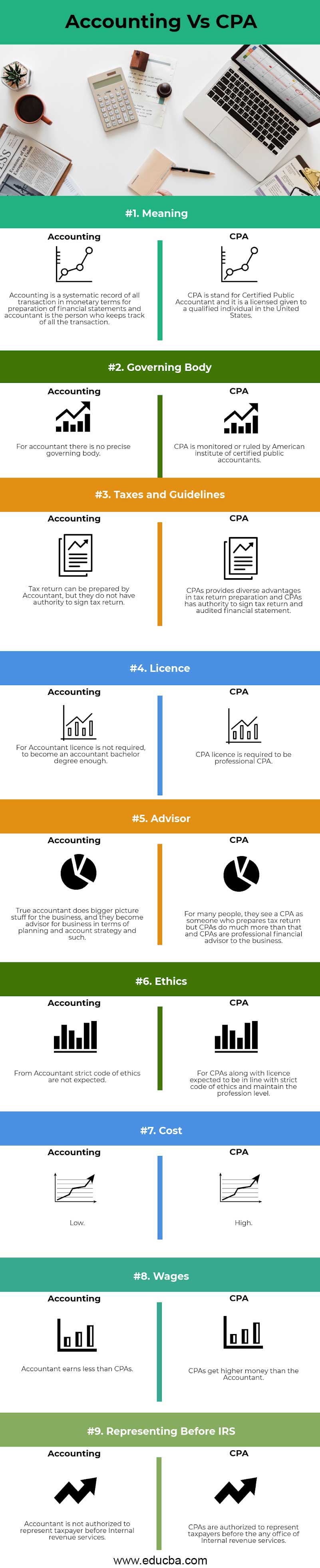

Accounting Vs Cpa Top 9 Differences You Should Know

How To Find The Right Cpa For Your Hoa

Accounting Vs Cpa Top 9 Best Differences With Infographics

Certified Public Accountant Cpa Certification Courses Requirements